Ad-free. Influence-free. Powered by consumers.

Get involved

Issues we work on

The payment for your account couldn’t be processed or you’ve canceled your account with us.

Sign In

We don’t recognize that sign in.

Your username maybe be your email address. Passwords are 6-20 characters with at least one number and letter.

We still don’t recognize that sign in.

Retrieve your username.

Reset your password.

*Required

*Required

Forgot your username or password?

Don’t have an account?

My account

Save products you love, products you own and much more!

Other Membership Benefits:

Suggested Searches

Cars

Car Ratings & Reviews

CARS

2024 Top Picks

Car Buying & Pricing

Which Car Brands Make the Best Vehicles?

Tires, Maintenance & Repair

Car Reliability Guide

Key Topics & News

CAR NEWS

Listen to the Talking Cars Podcast

Home & Garden

Bed & Bath

Top Picks From CR

Best Mattresses

Lawn & Garden

TOP PICKS FROM CR

Best Leaf Blowers

Home Improvement

Home Improvement Essential

Best Wood Stains

Home Safety & Security

HOME SAFETY

Best DIY Home Security Systems

Appliances

Kitchen

SURVEY RESULTS

Most and Least Reliable Refrigerators

Small Appliances

TOP PICKS FROM CR

Best Small Kitchen Appliances

Laundry & Cleaning

Top Picks From CR

Best Washing Machines

Heating, Cooling & Air

TOP PICKS FROM CR

Best Air Purifiers

Electronics

Home Entertainment

FIND YOUR NEW TV

Best TVs

Home Office

Save Money

Cheapest Printers for Ink Costs

Smartphones & Wearables

BEST SMARTPHONES

Find the Right Phone for You

Digital Security

Digital Security & Privacy

CR PERMISSION SLIP APP

One app to take back control of your data

More

Take Action

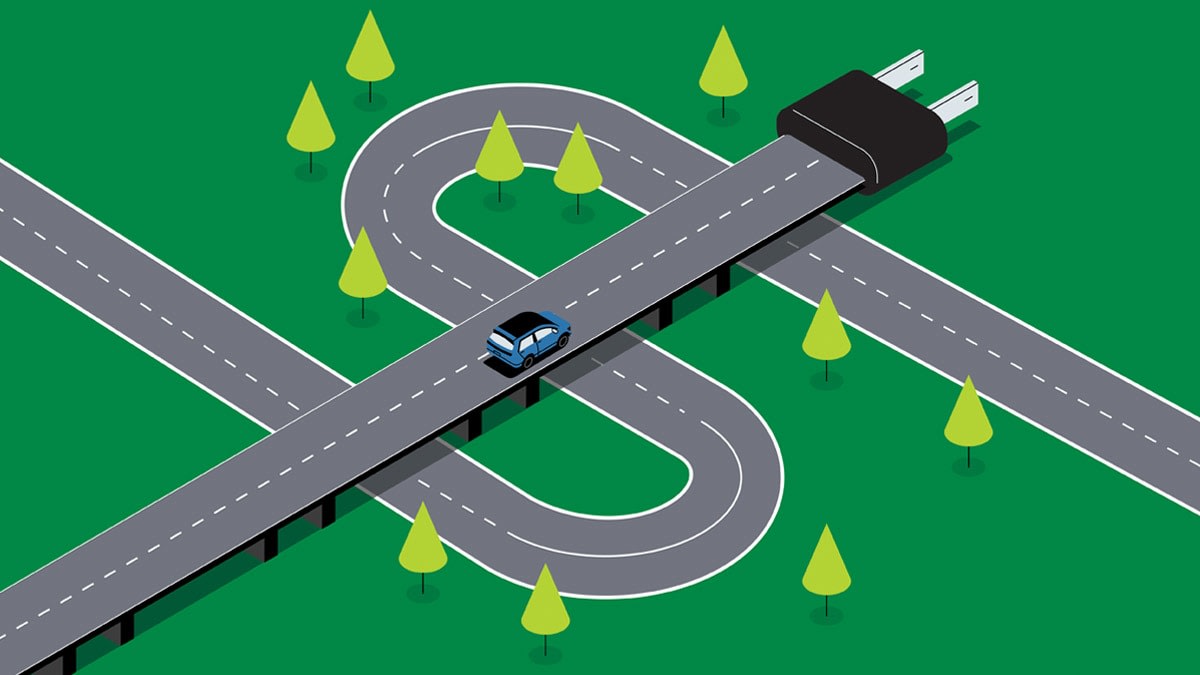

We calculated energy costs, tax credits, and hidden discounts, and have the answer.

Electric vehicles have a lot going for them. They create fewer greenhouse gas emissions than gas–powered vehicles, and their quick and silent acceleration means they’re fun to drive, too. So it’s no wonder that EV sales are growing—5.3 percent of U.S. new-car sales in 2022, up from 3 percent in 2021, according to the automotive research firm Wards Intelligence—while sales of conventional gasoline vehicles declined.

But sticker prices remain an issue. Most new EVs are luxury models with an average sale price of over $61,000—about $12,000 more than the industry average. EV buyers also need to calculate how much an electric car will cost to drive, including tax breaks and electricity rates. And those can vary depending on where you live, the vehicle you choose, whether you buy or lease, and even your annual income. “Figuring out how much an EV will cost can be complex, but it’s worth doing the math before making such a major purchase,” says Jake Fisher, senior director of auto testing at Consumer Reports. “An EV may make financial sense for many buyers, but some might be better off with a fuel-efficient hybrid.”

To help you better understand the costs and savings of an EV, CR will walk you through how to shop for one while saving money at each step.

See the Gas vs. Electric Car Savings Showdown, below.

Why it matters: Feedback from CR members who own EVs suggests that reliability is an especially important concern when going electric. In theory—because EVs lack engines, complex transmissions, and fuel or exhaust systems—they should cost less to service than gas-powered vehicles. On average, that’s true: A 2020 CR study found that EVs cut repair and maintenance costs by 50 percent over similar gas cars. You could save hundreds of dollars a year, but your actual savings will depend on the car.

How to save: “EVs are based on new technology—and some automakers are just making their first forays into the EV market,” Fisher says. “The companies might not have had the time to work out all of the production and design issues.” As a result, new EVs might have more problems early on. For instance, some EVs from Audi, Chevrolet, and Hyundai had battery issues in their first years of manufacture. While those have all since been resolved, it took time to work the kinks out.

To compensate, EVs offer generous warranties on parts like batteries and electric drivetrains (usually around eight years or 100,000 miles). To reduce the chance of problems, Fisher suggests starting with CR’s list of recommended EVs, and—as is our advice for gas-powered cars—sticking to ones that have been on the market for at least two years. “Tesla and Nissan have been mass-producing electric cars for over a decade, and the Model 3 and Leaf have very few problems with batteries, electric motors, or charging,” he says.

Remember: Complicated bells and whistles can cause trouble on both gas and electric cars. For example, problems with the Tesla Model X’s fussy in-car electronics are partly why this pricey EV ($109,990 to $119,990) has below-average predicted reliability.

Why it matters: The cost of the electricity to charge an EV is almost always hundreds of dollars less per year than the fuel expense for a similar gas-powered vehicle. But exactly how much can vary widely depending on the electricity rates and gas prices where you live. For example, electricity can cost twice as much per kilowatt-hour (kWh) in Connecticut as it does in Oregon.

How to save: Figuring out an EV’s energy costs is a lot more complex than doing the same for a gas-powered car. But the Department of Energy’s Alternative Fuels Data Center has an easy-to-use calculator at afdc.energy.gov/calc.

And it helps to keep a few general principles in mind. For example, if you live somewhere with high gas prices and low electricity costs, such as the West Coast, an EV will almost always be less expensive to run than a conventional car or hybrid. But in New England, where gas prices are lower and electricity prices are generally higher than out West, those savings may be negligible and tilt the balance in favor of a gas-electric hybrid with a less-expensive purchase price.

“Depending on local gas and electricity costs, hybrids might make better financial sense than EVs for some buyers, especially because many have outstanding long-term reliability,” Fisher says. Before deciding whether to buy an EV, see if your utility company offers discounted “off-peak” charging or if free charging is available at work or in your neighborhood. Some automakers, including Hyundai, Kia, Toyota, and Volkswagen, offer free access to certain high-speed public chargers for a few years after a vehicle purchase.

Why it matters: The Inflation Reduction Act (IRA), signed into law last year, expands some tax credits available to EV buyers but reduces or eliminates others. (For the latest about the program and eligibility, go to CR.org/evcredits.)

How to save: Credits of up to $7,500 depend on where the vehicle is made, its price, and the buyer’s income. Now, used EVs can also get a tax credit of up to $4,000.

Price: To qualify, a new EV must have an MSRP of under $55,000 for sedans and wagons and $80,000 for SUVs, vans, and trucks (regardless of dealer discounts). “We are also seeing some automakers, such as Tesla, slash prices so that their EVs can qualify for the IRA incentives,” says Quinta Warren, CR’s associate director of sustainability policy.

Where assembled: New vehicles assembled outside of North America—including the 2023 Hyundai Ioniq 5 and Kia EV6—aren’t eligible for a tax credit. And buyers might get less than the full $7,500 credit depending on where an EV’s batteries and electrical components come from. A car’s window sticker shows where it was made.

Income: New-car buyers must have an annual adjusted gross income below $150,000 for single tax filers and $300,000 for married couples filing jointly.

Why it matters: In addition to federal tax credits, EV buyers can potentially save thousands thanks to state tax breaks for car buyers, lower electric rates for EV owners to charge at home at certain times, or discounts on installing an at-home charger. As of July 2021, such incentives exist in 47 states and the District of Columbia, according to the National Conference of State Legislatures.

How to save: CR’s Electric Vehicle Savings Finder details what may be available to you based on where you live. For example, residents of Pasadena, Calif., might qualify for a $500 rebate from their utility company if they buy or lease their car from a local dealership, plus a $600 rebate and discounted electric rates depending on which charger they buy and when they plug in. EV owners in Orlando, Fla., can get $200 back from their power provider. And Massachusetts offers a generous $3,500 state tax credit on some EVs. “A recent CR survey showed that nearly half of Americans aren’t aware of the incentives available to them,” says Chris Harto, CR’s senior policy analyst for transportation and energy. “Even if you live in a state you wouldn’t think would have incentives, you may be surprised by what ’s available.”

Dealers or leasing companies can get a $7,500 commercial incentive for each EV they lease even if it doesn’t qualify for an incentive if sold to an individual. That means those leased vehicles aren’t subject to most of the restrictions that apply to EV purchases.

How to save: If you make too much to qualify for a tax credit, the car you want is too expensive, or the vehicle isn’t made in North America, consider leasing instead of buying. The dealership can pass its savings on to you by lowering the negotiated total vehicle price that the lease is based on. “If you’re leasing a car, make sure to ask for an itemized bill of sale that shows where the tax credit has been applied,” says Gabe Shenhar, associate director of CR’s Auto Test Center. “And make sure the dealership hasn’t raised the price to make up the difference.”

We put four popular, well-equipped EVs against evenly matched gas or hybrid competitors to see how much you’ll pay in gas or electricity (if you charge at home) to drive 12,000 miles a year. Then, after accounting for tax credits, we compared overall costs in different states that are representative of national energy price trends. From these charts, you can get a sense of whether an EV could save you money. EVs can also cost less to repair and maintain, but we haven’t included those savings here because the exact amount will differ from model to model. Where possible, we included vehicles from CR’s list of recommended EVs.

Calculations below are based on 48 mpg for the Toyota Corolla and 3.23 mi/kWh for the Nissan Leaf; 29 mpg for the BMW 330i and 3.33 mi/kWh for the Tesla Model 3; 35 mpg for the Hyundai Tucson and 2.94 mi/kWh for the Hyundai Ioniq 5; and 20 mpg for the Ford F-150 Hybrid and 2.08 mi/kWh for the Ford F-150 Lightning.

Calculations assume that buyers will qualify for the most common federal and state tax credits and that qualifying vehicles will at least be eligible for a $3,750 partial federal tax credit.

Source: Gas prices: AAA; electricity prices: U.S. Energy Information Administration; MPG ratings: CR; EV efficiency ratings: fueleconomy.gov.

The Tennessee-built Nissan Leaf SV Plus qualifies for at least $3,750 in federal tax credits and maybe state credits, too. But it costs so much more than a Corolla Hybrid up front that there’s no situation in which the Nissan EV makes up for its cost premium over the Toyota hybrid in tax and fuel savings alone. That’s largely because the Corolla Hybrid is so efficient, getting 48 mpg overall in our tests. Note that in some states, a base-model Leaf costs less up front to purchase than a Corolla Hybrid after tax incentives, saving money right away, but it has a much shorter driving range than the Leaf Plus.

The Tesla Model 3 isn’t just quicker and greener than a comparably equipped BMW 3 Series—it also costs less. After a federal tax credit, an all-wheel-drive Model 3 could save buyers at least $2,755 at the time of purchase, and those savings would continue every time you plug it in, adding up to about $8,000 over a five-year period. Although the Tesla’s choppy ride and distracting in-car controls hurt its Overall Score, the Model 3 is still an excellent choice. “The Model 3 is packed with technology, and its quick acceleration and nimble handling put many sports cars to shame,” says CR’s Jake Fisher. “So the significant savings from lower fueling costs are just the icing on the cake.”

If you’re buying a small SUV, it might make sense to shop for a hybrid instead of a pure EV. We like the Tucson Hybrid, which gets 35 mpg overall. “Small SUVs are the heart of the market, but consumers don’t really have an affordable, reliable choice when it comes to buying an electric version,” Fisher says. (The Chevrolet Bolt EUV and Volkswagen ID.4 cost less than the Hyundai Ioniq 5, but reliability issues mean they’re not CR Recommended.) The Ioniq 5 isn’t made in the U.S., so it doesn’t qualify for a federal tax credit, although state tax credits help. Leasing could make the Ioniq 5 more affordable, too.

If you live in a region with relatively high gas prices and low electricity costs, a well-equipped Ford F-150 Lightning Extended Range pickup truck might save you enough money on fuel alone to make buying a pricier EV a better choice than a similar hybrid version, which only gets 20 mpg overall. “Because pickups use so much gas, electrification can save truck buyers a substantial amount,” according to Fisher. The Extended Range model’s MSRP is just over the $80,000 limit to qualify for a federal tax credit, but a less-expensive version of the F-150 Lightning, which comes with a standard 240-mile-range battery, may be eligible for both federal and state credits, so you could start saving even sooner.

Editor’s Note: This article also appeared in the April 2023 issue of Consumer Reports magazine.

Keith Barry

Keith Barry has been an auto reporter at Consumer Reports since 2018. He focuses on safety, technology, and the environmental impact of cars. Previously, he led home and appliance coverage at Reviewed; reported on cars for USA Today, Wired, and Car & Driver; and wrote for other publications as well. Keith earned a master’s degree in public health from Tufts University. Follow him on Twitter @itskeithbarry.

We respect your privacy. All email addresses you provide will be used just for sending this story.

Trending in Hybrids/EVs

Which Car Brands Have the Highest Road-Test Scores?

Electric Cars and Plug-In Hybrids That Qualify for Federal Tax Credits

Best Cars of the Year: 10 Top Picks of 2024

How Long Does It Take to Charge These Popular Electric Cars?

source

Leave a comment